24+ Front end dti calculator

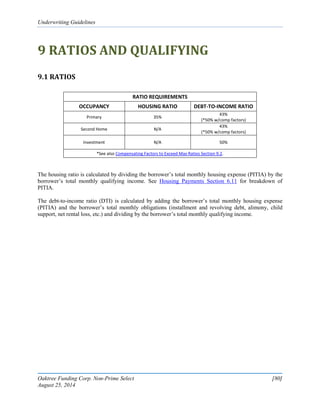

Front End vs Back End DTI This calculator shows your frontend backend debt to income ratios. Debt-to-Income Ratios 12042018 Fannie Mae This topic contains information on the use of the debt-to-income DTI ratio including.

Non Prime Select Guidelines Call Jesse B Lucero 702 551 3125

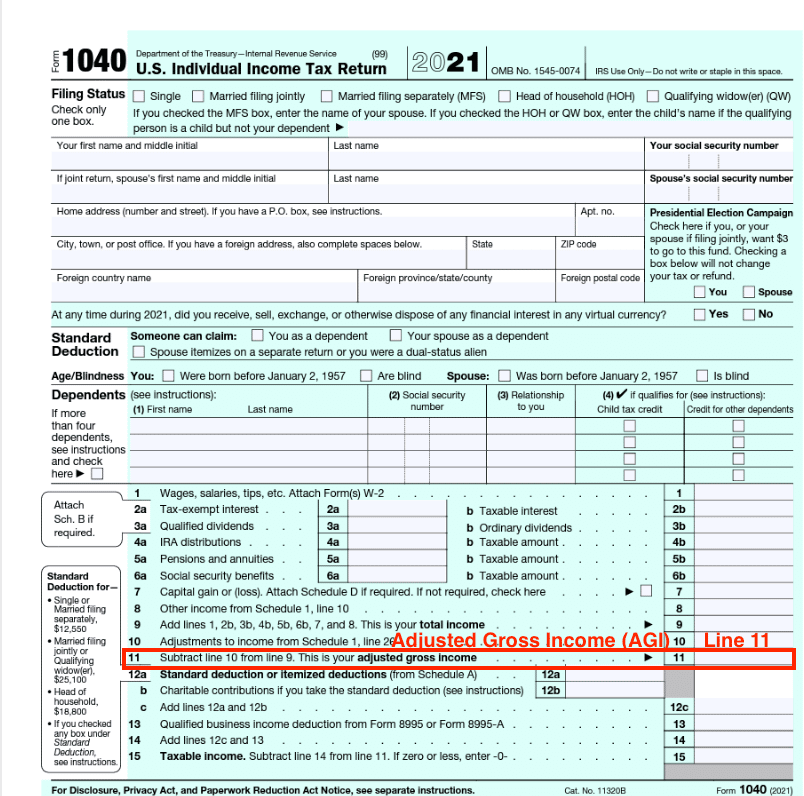

Income and debt Annual income before taxes including non.

. None of the requirements in this table are. To get the percentage you multiply the quotient by 100. This calculator uses the following formulas to calculate debt-to-income ratios.

There is no other. What is your front-end ratio. Below mentioned is the formula to calculate the front-end DTI.

Front End Debt To Income Total Housing Expense Monthly Gross Income x 100. Front-End Ratio Monthly Housing Debt Gross Monthly Income Back-End Ratio All Monthly Debt Gross. Now you are ready to.

Calculate Your Debt to Income Ratio Use this worksheet to figure your debt to income ratio. Lets take an example. To get the percentage youd take 03 and multiply it by 100 giving you a DTI of 30.

If you have a salary of 72000 per year then your usable income for purposes of calculating DTI is 6000 per month. To determine your DTI ratio simply take your total debt figure and divide it by your income. Generally speaking a debt ratio greater than or equal to 40 indicates you are not a good.

Front end ratio is a DTI calculation that includes all housing costs mortgage or rent private mortgage insurance HOA fees homeowners insurance property taxes etc How. Historically lenders have preferred the front end ratio to be below 28. This number will be compared against your income to calculate your back end ratio.

To calculate the debt-to-income ratio add up all your monthly. Veterans United recommends a DTI of 41 or lower with mortgage debt included in the DTI calculation. Heres a simple two-step formula for calculating your DTI ratio.

The FHA DTI Mortgage Calculator at Gustan Cho Associates has been custom designed to get the most accurate front-end and back-end DTI used by mortgage underwriters. You derive your frontend DTI ratio by dividing your monthly housing expenses by your monthly gross income. Jan 24 2022 805AM EST.

Monthly debt Gross monthly income 100 Debt-to-income ratio How to lower your debt-to-income ratio. Add up all of your monthly debts. Monthly mortgage or rent payment minimum credit card.

The GCA Mortgage Calculator powered by Gustan Cho Associates will calculate the most accurate estimated PITI principal interest taxes insurance PMI or MIP HOA and front and. Higher ratios may still be allowed but borrowers with a DTI of 41 or higher will. The accuracy of the DTI calculation is based on the accuracy and completeness of the information provided by you.

These payments may include. The calculation for the. The front-end-DTI ratio also called the housing ratio.

To calculate the front-end DTI add up your expected housing expenses and divide it by how much you earn each month before taxes your gross monthly income. DTI is always calculated on a monthly basis. The following table breaks down your monthly housing expenses and shows your resulting front-end DTI ratio.

Front-end DTI 1750 6500 100 0269230769 100 2692 Based on.

News Archive Rutgers School Of Graduate Studies

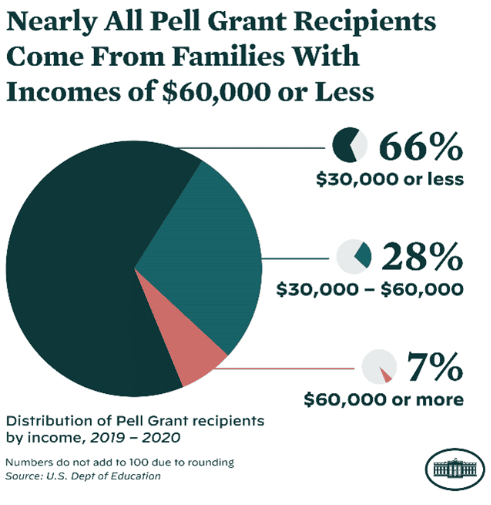

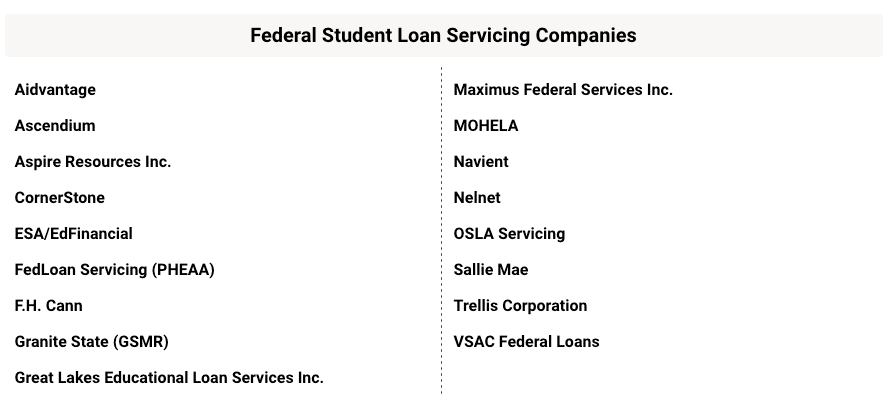

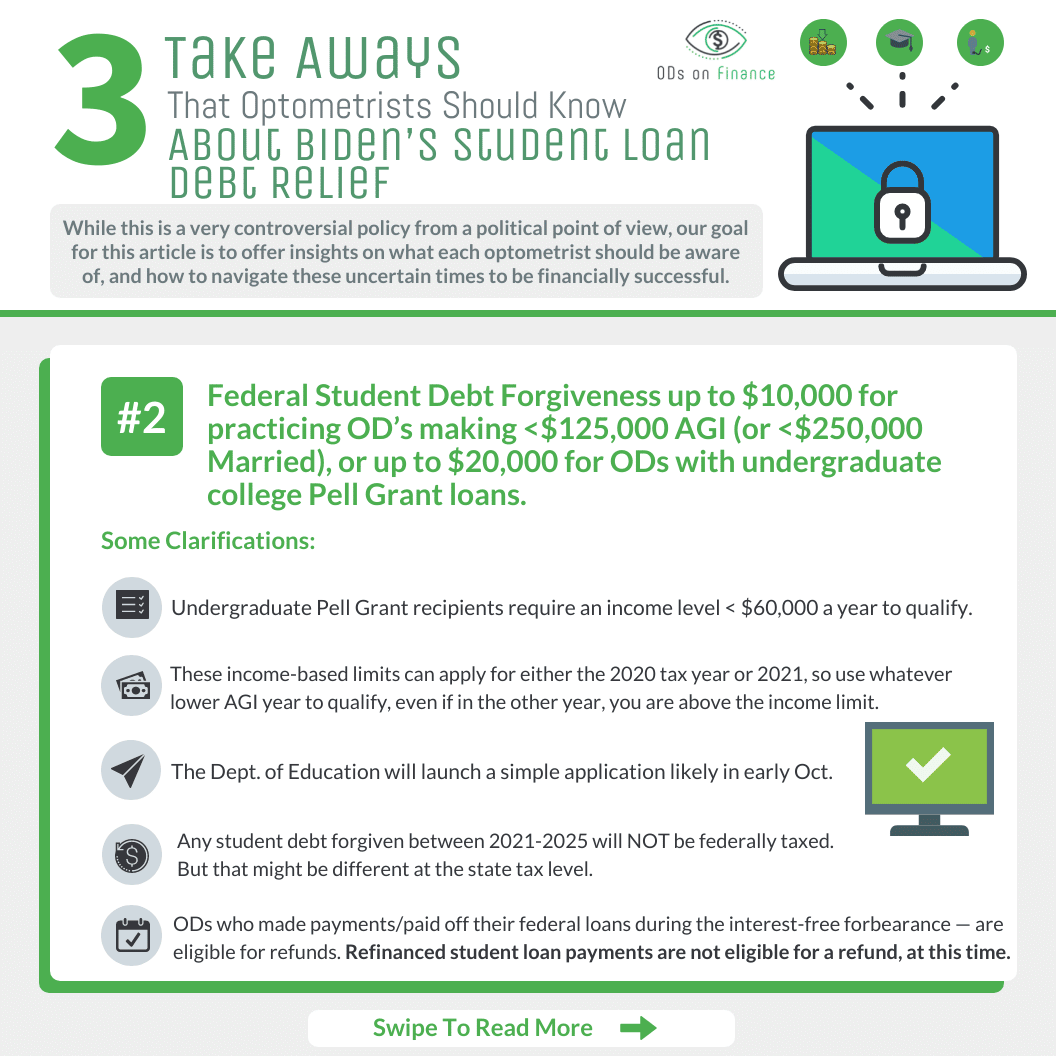

3 Take Aways That Optometrists Should Know About Biden S Student Loan Debt Relief Ods On Finance

2

Non Prime Select Guidelines Call Jesse B Lucero 702 551 3125

What Is The Mortgage Insurance Premium On A Kentucky Rural Housing Usda Loan Kentucky Usda Mortgage Lender For Rural Housi Mortgage Loans Usda Loan Mortgage

3 Take Aways That Optometrists Should Know About Biden S Student Loan Debt Relief Ods On Finance

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Incredible 2 Months From 2nd Of December Conventional Loan Mortgage Loans Mortgage Refinance Calculator

3 Take Aways That Optometrists Should Know About Biden S Student Loan Debt Relief Ods On Finance

2

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

3 Take Aways That Optometrists Should Know About Biden S Student Loan Debt Relief Ods On Finance

Non Prime Select Guidelines Call Jesse B Lucero 702 551 3125

How To Buy A Home Step By Step Process Secure Investments Realty And Management

2

2

3 Take Aways That Optometrists Should Know About Biden S Student Loan Debt Relief Ods On Finance